17 tips to manage your small business finances

Content

- The Importance of National Hispanic Heritage Month

- Are commercial loans a good funding option for small businesses?

- What does financial management mean for business owners?

- What is accounting?

- Will I qualify for invoice factoring with no business credit history?

- Benefits of the API and Embedded Finance

To build an inventory, you need various kinds of information like sales volume, current stock levels, outdated stock levels. All these things make the application process easier and can be an aid for your business in difficult times. You have to keep a sharp eye on your business performance and the financial conditions to make the right decision while taking a loan. Good business financing is about taking care of even the tiniest details. However, you always have to be aware of that thin line of difference between taking a loan your business can handle and loans that spiral out of control.

- Get acquainted with the most common late payment excuses and learn how to respond to each one.

- However, over the longer term, if the business struggles to breakeven, it’s a sign that it may not be financially viable.

- A business must produce sufficient cash inflows to purchase raw materials, finance payroll, and pay for marketing costs.

- Sometimes banks ask small business owners to use personal property such as a home or retirement savings as collateral as well.

Cost-cutting measures can include reducing office supply expenses, canceling cleaning services, conducting meetings in coffee shops instead of hired meeting rooms, etc. When a simple loan starts turning into a big problem, cost-cutting measures are the safest way to deal with it, as your ability to continue selling is not affected much. This means recording all the costs your business is incurring for the units being sold, along with the overhead costs.

The Importance of National Hispanic Heritage Month

There are purchase orders that need to be sent, invoices that need to be followed up, budgets that need to be approved, and reports that need to be run. Often, your small business is successful because of your expertise in making your product or providing your service. Unfortunately, you might not be an expert at the other important parts of running a business, such as managing finances. If you don’t have a lot of experience with managing business finances, it can be a challenge, but it’s also crucial to the survival of your business.

- On the other hand, it will be much easier to get some help at the beginning of your business journey.

- This means ensuring that all your vendors have received their payments, and if not, you can look into the problem and solve it.

- Whenever you are working with a variety of vendors, it can be difficult to keep up with whom you owe what.

- To avoid running into issues such as improper taxation details or chaotic bookkeeping, it is wise to plan your accounting strategy well beforehand.

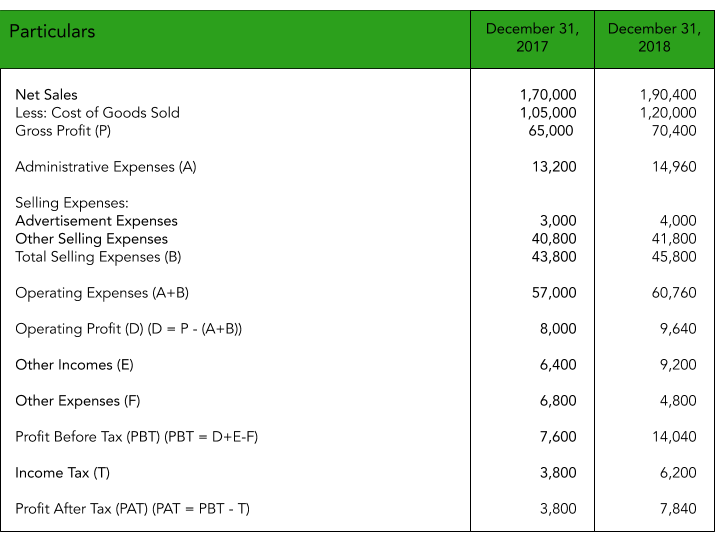

For comparison, use FundThrough’s Pricing page to find the total cost of funding your invoices. EPS measures how much profit a business generates for each share of common stock. If you can produce more earnings per share, the common stock is more valuable. When you increase EPS, you can pay a portion of earnings as a dividend to shareholders and retain some earnings for use in the business. If liabilities are increasing at a faster rate than equity, your firm may be taking on too much debt.

Are commercial loans a good funding option for small businesses?

Your business’s cash flow can also be improved by having access to a line of credit. Corporate credit cards are the ultimate solution to a chaos-less digital spending way for your business. These plans and strategies will come under an effective business financing system. The amount left after deducting expenses from the total revenue is the profit earned.

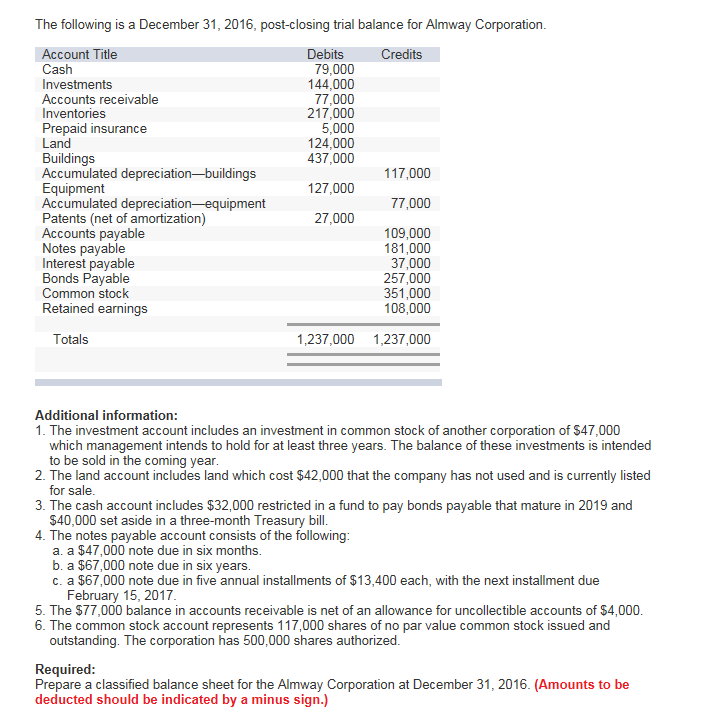

Imagine using a large piece of business equipment as collateral, then losing a major contract that caused you to default on your loan. Your ability to do business at all could be limited or even eliminated. Sometimes banks ask small business owners to use personal property such as a home or retirement savings as collateral as well. You can use ratio analysis to assess your firm’s liquidity, solvency, and other factors. If sound financial management helps companies plan for the future, accounting practices that produce accurate financial statements is what enables them to do so.

What does financial management mean for business owners?

Invoice factoring is a great short term financing option for seasonal businesses. When you have a short window of time in which to do business each year, you can’t afford to wait 30, 60, or 90 days to get paid so you can put those funds to work. FundThrough allows you to get paid right away while your customer pays according to the agreed upon terms, so you can free up cash flow to buy supplies, pay your team, and otherwise run your business.

Be diligent in every step of the process but, most importantly, in whom you decide to extend credit. Start by setting up a professional credit application that gives you a chance to get as much info as you can on these customers. Use this info to vet them so you are making informed credit decisions. Once you’ve decided to move forward on https://quickbooks-payroll.org/ credit with a customer, be sure you have a contract that clearly states the terms you are operating on and that the customer knows when they must pay you. Also, be sure you are using top-notch invoicing software so you have an excellent way to keep an eye on your accounts and get your invoices to customers as seamlessly as possible.

What is accounting?

Likewise, don’t take out loans with interest rates that you can’t afford. An income statement is a financial statement that reports a company’s financial performance over a specific Ultimate Guide to Small Business Finance Management accounting period. Financial performance is assessed by giving a summary of how the business incurs its revenues and expenses through both operating and non-operating activities.

Being a small business owner, it can be a good idea to invest in financial management software designed for your unique goals, thus saving money in the long run. With custom financial software development for small businesses, you can easily add new functionality, as your business grows. While integrating an off-the-shelf small business financial management software might seem like the cheapest option, building custom software is more cost-effective in a long run.